This plan is an important first step in strengthening our community and an opportunity to bring many of the resources we currently lack in our neighborhood. “We came into these negotiations with very high expectations because we are a community of hardworking residents who have, against all odds, thrived in underserved neighborhoods that have seen very little affordable housing development in the last 50 years. “My community deserves the best,” said Council Member Ydanis Rodriguez. I also thank Speaker Johnson, Land Use Committee Chair Salamanca and the entire Council for joining us in our fight for affordable housing and strong neighborhoods.” “I thank Councilmember Rodriguez for his partnership in creating a bold plan that will benefit the community for generations to come. It means affordability, security, and opportunity for residents and new immigrants alike,” said Mayor de Blasio. “The approval of the Inwood neighborhood rezoning means a fairer, stronger future for a community that has experienced decades of disinvestment. Approval of this plan concludes more than three years of community-driven planning efforts to create new affordable housing and economic opportunities for Inwood residents.

The de Blasio Administration and Council Member Ydanis Rodriguez today celebrated the City Council’s approval of the Inwood neighborhood rezoning, the City’s plan to ensure Inwood remains an affordable, attractive neighborhood for working and immigrant families. E01: Leslieville, Riverside, Little India (Average condo price May 2018, $768,234, $122,720 income required to afford condo) 5.Plan delivers over $200 million in new public investment for affordable housing, waterfront parks, STEM education, and cultural institutions C02: Yorkville, Annex, Summerhill (Average condo price May 2018, $872,506, $139,376 income required to afford condo) 4. C12: York Mills, Bridle Path, Hoggs Hollow (Average condo price May 2018, $898,788, $143,574 income required to afford condo) 3. C09: Rosedale, Moore Park (Average condo price May 2018, $966,133, $154,332 income required to afford condo) 2. E04: Dorset Park, Kennedy Park (Average condo price May 2018, $364,466, $58,220 income required to afford condo) Top 5 Least Affordable Toronto Condo Neighbourhoodsġ. W05: Black Creek, York University Heights ((Average condo price May 2018, $348,797, $55,717 income required to afford condo) 5. W10: Rexdale-Kipling, West Humber-Claireville (Average condo price May 2018, $346,796, $55,397 income required to afford condo) 4. E11: Malvern, Rouge (Average condo price May 2018, $332,969, $53,189 income required to afford condo) 3. E10: West Hill, Centennial Scarborough (Average condo price May 2018, $253,822, $40,547 income required to afford condo) 2.

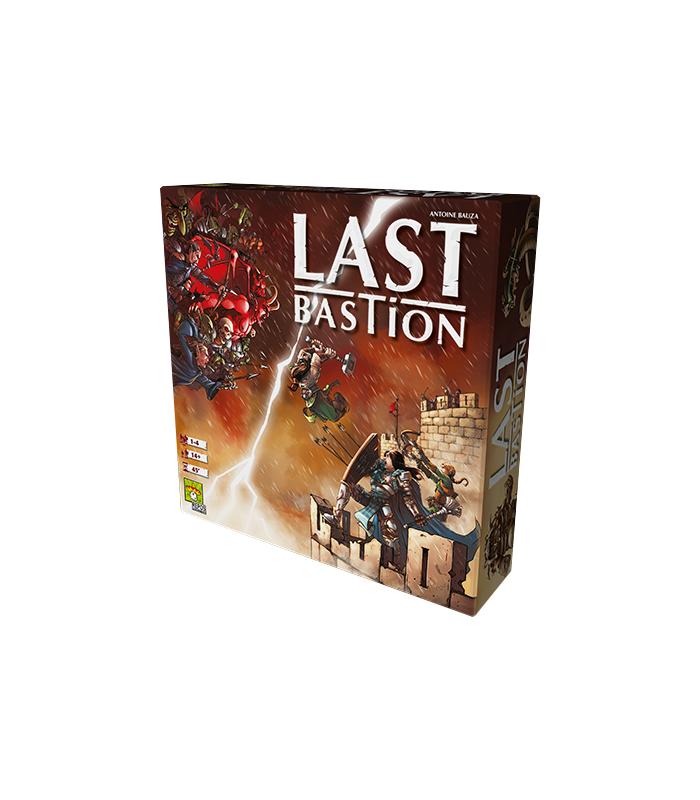

Top 5 Most Affordable Toronto Condo Neighbourhoodsġ. Assuming a 20-per-cent down payment, this would qualify this household for a maximum mortgage amount of $591,347 - attainable in 18 of the 35 examined neighbourhoods. Not surprisingly, home affordability is a far greater possibility for those in dual-or-more-income households.Īccording to the 2016 Census, the median take-home pay is $96,294. To identify the Toronto neighbourhoods with the greatest condo affordability, Zoocasa compared the average price in each area (sourced from the Toronto Real Estate Board) to the city’s average, as well as the median income earned in Toronto households. Of course, real estate prices vary across different Toronto neighbourhoods. READ: This Toronto Condo Developer Plans To Sell Units For $2,500 Per Square Foot So condos, while certainly still expensive ($602,804 the average price for a Toronto condo apartment this year), are often more affordable. Single-family homes are often too expensive for aspiring home buyers. Toronto condos have long been seen as the last bastion of affordability in our real estate market.

0 kommentar(er)

0 kommentar(er)